☏Ph: 1-403-899-6574 ✉ info@axemortgagebrokers.ca

How will tariffs and interest rates impact Canada's home prices? What places in Canada can offer better affordability? It is a buyer's market? Read on for some answers.

New listings jumped by double digits in January 2025 compared to December 2024. But that didn't stop sales from declining sharply in the last week of January enough to bring the month down — suggesting Canadians halted their home-buying plans due to tariff threats by U.S. President Trump.

Canadian interest rates have fallen since last year, but with trade disruption already entering the room, it's a recipe for market uncertainty in the next few months.

Next CREA update is coming on March 17, 2025. Keep that double-double in hand as we gauge Canadian housing markets heading into spring.

$709,200 in January 2025 (an increase of 0.1% m/m from December's $705,600) This stat logged a (marginal) increase of 0.5% year-over-year and was lower by 17.1% from the $855,800 peak MLS®HPI recorded in March 2022. (as per MLS® HPI Aggregate Composite Benchmark, not seasonally adjusted)

Tariff trouble ahead? Cooler housing demand could thin out an anticipated spring rush.

Buyers waiting for lower interest rates may continue to hold off, now worrying about their financial futures with trade disruption sitting on the living room couch. The potential exists for sellers to keep listing to snag the few buyers out and about, hoping to get a higher home price or escape restrictive interest rates, especially with over 1M renewals coming this year.

Such a demand-light, inventory-heavy scenario could bring home-price relief at a time when interest rates are still dropping.

Keep in mind that the trade disruption will raise house-building costs as supply routes try to realign — thwarting future home and rental construction when more is needed to improve affordability in Canada.

The Canadian Real Estate Association (CREA) recently upgraded its 2025 housing market prediction, eyeballing a higher 8.6% (from 6.6%) increase in national home sales and an increase of 4.7% (from 4.4%) in national average home prices this year.

Trumps tariffs may have something to say about that — stay tuned.

The federal government brought in two insured mortgage rule changes for home buyers:

Dan Eisner, founder and CEO of True North, commented last year on the new rules: "First-timers finally get some help to bid on a home closer to where they might work. Home buying will likely be more attainable, with mortgage payments that are more affordable."

Despite improved access to insured mortgages, Canadians are still caught in a cat-and-mouse game as lower interest rates enhance affordability while higher Canadian home prices and budget challenges push back.

Are housing forecasts for real, or are they just 'Pin the Tail on the House Donkey' in predicting where home prices might go?

Housing experts can differ widely on what's happening with our housing markets. No doubt, that's partly due to Canada's size, with regional differences often skewing the big 'housing landscape' picture (for example, Vancouver and Toronto's outsized and outlandish prices and housing demand).

Here's how these forecasts for 2024 panned out (compared to 2023):

Toronto-based Oxford Economics Canada predicted house prices would take a hit in the second half of 2024 as a result of the growing financial strain on households:

So, as you can see, forecasts are guidelines rather than rules. Stay tuned for this year's industry predictions!

Tight home affordability in Canada has backed off a bit in the last couple of months as fixed mortgage rates and home prices cooled slightly. However, home prices in Canada are still the highest of the G7 countries (led by the major city centres of Vancouver and Toronto).

Here's what may help keep price growth in check to either deter demand or increase supply:

In 2023, we saw a whopping 46% increase in Canadian newbies waving the red maple leaf.

However, as 2024 comes to a close, immigration is being curbed, and temporary resident outflow reached over 660K this year. Increased tightening and outflow are expected in 2025 and beyond.

Still, our rapid population growth over the past couple of years, combined with not enough housing starts to keep pace, puts significant pressure on our future home supply, suggesting that over time, home prices could go higher, not lower.

Factors that could affect the pace of homes being built:

Federal, provincial, and city governments are furiously trying to clear the road to increase starts or increase the incentive to increase starts.

NIMBYism (not in my backyard) is another major obstacle in the way of slapping up multi-dwelling housing in existing neighbourhoods to ease the strain. (Calgary and Edmonton seem to have less trouble getting shovels in the dirt — both these cities have led national starts for months now.)

Many forces in Canada seem to be at odds, interfering with the pace of the Canadian housing inventory needed to keep up with current and future needs. We're not talking here about housing for low-income needs, which is also very urgent and essential — we're talking about enough housing to meet the general demands of an existing and growing population.

Canada is down over 5 million homes needed by 2030 (on top of annual construction). The lack of inventory won't help stabilize home prices unless reasonably addressed in the coming years.

Typically, lowering interest rates attracts buyers and stokes housing demand. But this time around, a brand new trade war with the U.S. is already sending shockwaves through economic channels that may further spook buyers, which has the potential to reduce demand compared to what was expected for 2025 — even if rates go lower.

For the time being, however, home affordability is still at an all-time low in Canada, with high home prices (still down only about 17% from the 45% peak of March 2022), higher interest rates, and elevated prices all around.

It remains to be seen whether a potential recession from trade disruption would keep buyers from entering the market to snag lower interest rates (increase demand enough to push up home prices).

There may be more sellers listing due to tariff turmoil but for the opposite reasons — worried about getting a good price for their home.

How home prices are viewed depends on the perspective. Many new buyers want prices to go down, but sellers want them to stay higher (for obvious equity reasons).

According to National Bank stats, mortgage affordability improved again in Q3 2024, with lower interest rates and increased income seeing 9 of 10 Canadian centres eased:

And, according to BMO (Bank of Montreal), a mortgage rate below 4.0% plus a 30-year amortization brings us back to pre-pandemic levels for mortgage payments as a percentage of household income.

National average home prices in Canada are among the highest in the G7 countries. There's been talk of housing bubbles here for years. Yet, nothing has burst (yet), and homeowners take tremendous pride in owning a home, riding local price waves up or down.

To help you time your home-buying or selling decisions, here's a snapshot of our nation's current housing market trends and a look ahead to what experts say is coming to a market near you.

January 2025 — The three Canadian centres with the highest average MLS® home prices are:

Based on the MLS®HPI Composite Benchmark (not seasonally adjusted)

January 2025 — The six Canadian centres with the lowest average MLS® home price.

We're not saying you should (or could) move there, but you can dream about how much home you'd get for the prices.

Based on the MLS®HPI Composite Benchmark (not seasonally adjusted)

BALANCED – The national SNLR (sales to new listing ratio) eased to 49.3% in January from 56.9% last month.

New listings increased by 12.7% year-over-year to improve the SNLR — though they were still below the long-term average for this time of year.

A few other details:

Why is the market balance easing? More inventory came on board from over-leveraged homeowners or those wanting to get their home sale over and done before spring or tariffs, whichever comes first. Check back next month for an update!

Market disparity? Always. Regardless of national or even provincial sales and listing averages, Canada is a big country (area-wise), and home shoppers and sellers can find very different market conditions depending on where they're buying or selling.

According to CREA (Canadian Real Estate Association), a strong buyer's market is when the sales-to-new-listings ratio (SNLR) is 45% or below.

At that ratio percentage, there are typically more properties for sale than buyers, offering more choice and bargaining power — especially in placing purchase offers with conditions that protect a buyer's rights and finances.

When the SNLR falls between 45% and 65%, market conditions are considered 'balanced' in buyer demand, available listings, and sales levels that keep prices relatively stable, thus allowing reasonable purchase and sale terms.

The middle ground of housing competition — balanced markets can lean more towards the buyer's or seller's spectrum. And despite any prevailing national or local trends, a particular house, street or area can defy it (you know who you are).

An SNLR of 65% or higher is a market that strongly favours the seller.

A seller's market means there are more buyers than sellers, and the properties sell quickly and at higher prices, giving the seller more power to set their price and terms of sale.

When the demand for housing exceeds supply, buyers often resort to a gamut of strategies to snap up a house before others, such as engaging in bidding wars or feeling pressured to place no-condition offers.

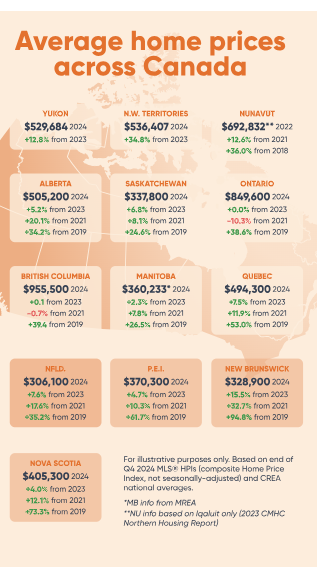

This graphic offers a provincial snapshot of prices in Q4 2024 compared to 1 year, 3 years, and 5 years ago.

As you can see, most home prices in Canada have increased over the past 5 years.

Want an even more interesting stat? The average Canadian MLS®HPI composite benchmark home price has risen almost 200% since 2005 (over 20 years)!

Here are a few multi-numbered sources to keep you busy and in the know:

Our friendly, highly trained brokers can help you get the best rate and better mortgage options, saving you thousands.

We can also offer unbiased advice for first-time and next-time buyers for affordability strategies that may make the difference in owning and keeping a home in Canada.

Make sure to ask about features such as portability, free payment frequency changes and mortgage recasting, as well as products like Purchase + Improvements when looking to buy your next home.

Are your mortgage details more complex?

We have the flexibility to help customize a short-term solution. Get in touch with your expert broker here.